Home Personal Finance & Investment Homo Sapiens: Decoding My MPF Outperformance

Homo Sapiens: Decoding My MPF Outperformance

Anthony Tran • Posted 1 year ago

An ordinary person of humble background. In my youth I ventured into the sports journalism field, later navigating the fund industry, wielding the pen for investment, and eventually took on a role at a securities firm focused on research and strategy. Though I hold the Chartered Financial Analyst (CFA) designation, studied cognitive science at university, and trained independently in the art of triathlon, all these are but fleeting pursuits.

0

1

Hong Kong's Mandatory Provident Fund (MPF) system is often criticised, but active management can make a big difference. My MPF portfolio achieved a 16.94% return in the first nine months of 2024, outperforming market averages. Read the full analysis to learn how.

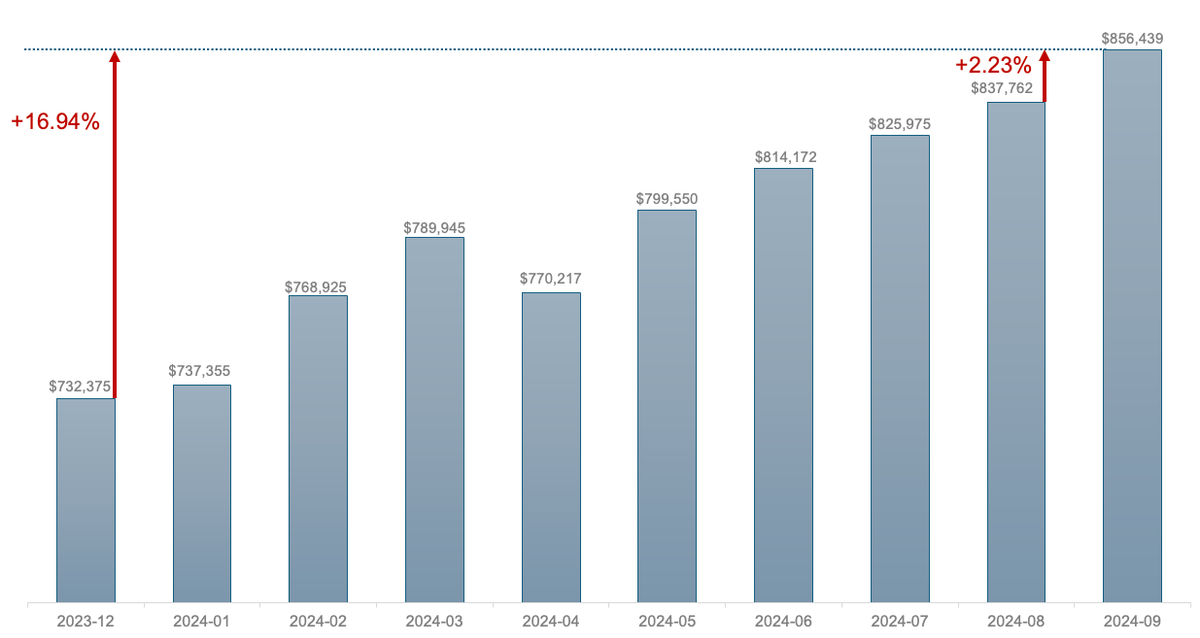

As we conclude September 2024, my Manulife MPF portfolio ("my MPF Portfolio") closed with gains. Its net asset value increased from HK$837,762 to HK$856,439, up 2.2% for the month (Fig. 1). In the first nine months of 2024, my MPF Portfolio has gained 16.94%, outperforming the average MPF fund performance, as represented by a 12.77% increase in the MPF Ratings All Fund Performance index.

Fig. 1: My MPF Portfolio: Net Asset Values (year-to-date) HK$

Source: Manulife MPF Scheme monthly statements, data in Hong Kong dollars, from 2023-12-31 to 2024-09-30. Net asset values, and returns are net of all fees.

The year-to-date outperformance (417 basis points) is the result of active management in my MPF Portfolio, which is a fund-of-funds (multi-manager) pension investment, where I actively rebalance across various equity, bond, and cash funds within the Manulife MPF Scheme. I base my allocation decisions on momentum and valuation metrics, aiming to generate returns while mitigating downside risks amidst evolving macro trends.

Please upgrade to our premium member plan to read the full content

Upgrade Now0

1

Popular Tags

Popular Articles

Copyright ©2025 Fortress Hill Media limited. All rights reserved